Invest Better

By Overcoming Your Emotions.

While other apps nudge you toward impulse trading,

we help you stay grounded, see the bigger picture,

and avoid costly emotional decisions, across market cycles.

Your Investment Journey Transformation

Drag the slider to see the difference

How emotions destroy wealth

How wisdom builds wealth

Built by Investors Like You,

Just For You

We focus on the tools that help you stay rational, avoid emotional traps, and build wealth through wisdom.

Rational Mindset

Overcome emotions and make decisions based on data, logic, and long-term wisdom rather than fear or greed.

Long-Term Perspective

Focus on decades, not days. Build patience and discipline to ride through market cycles and avoid short-term noise.

Second-Level Thinking

Question the herd and experts, and think independently. Go beyond what everyone else is thinking to find real opportunities.

Avoid Hindsight

Focus on the decision-making process, not just outcomes. Learn from actual experience rather than reconstructed memories.

Self-Awareness

Understand your biases, emotions, and decision-making patterns. Know yourself to invest better.

Adaptive Discipline

Stay committed to your philosophy while remaining flexible enough to learn and evolve with market conditions.

Feature Highlights

Explore our comprehensive suite of powerful tools designed to transform your investment journey with data-driven insights and intelligent analytics.

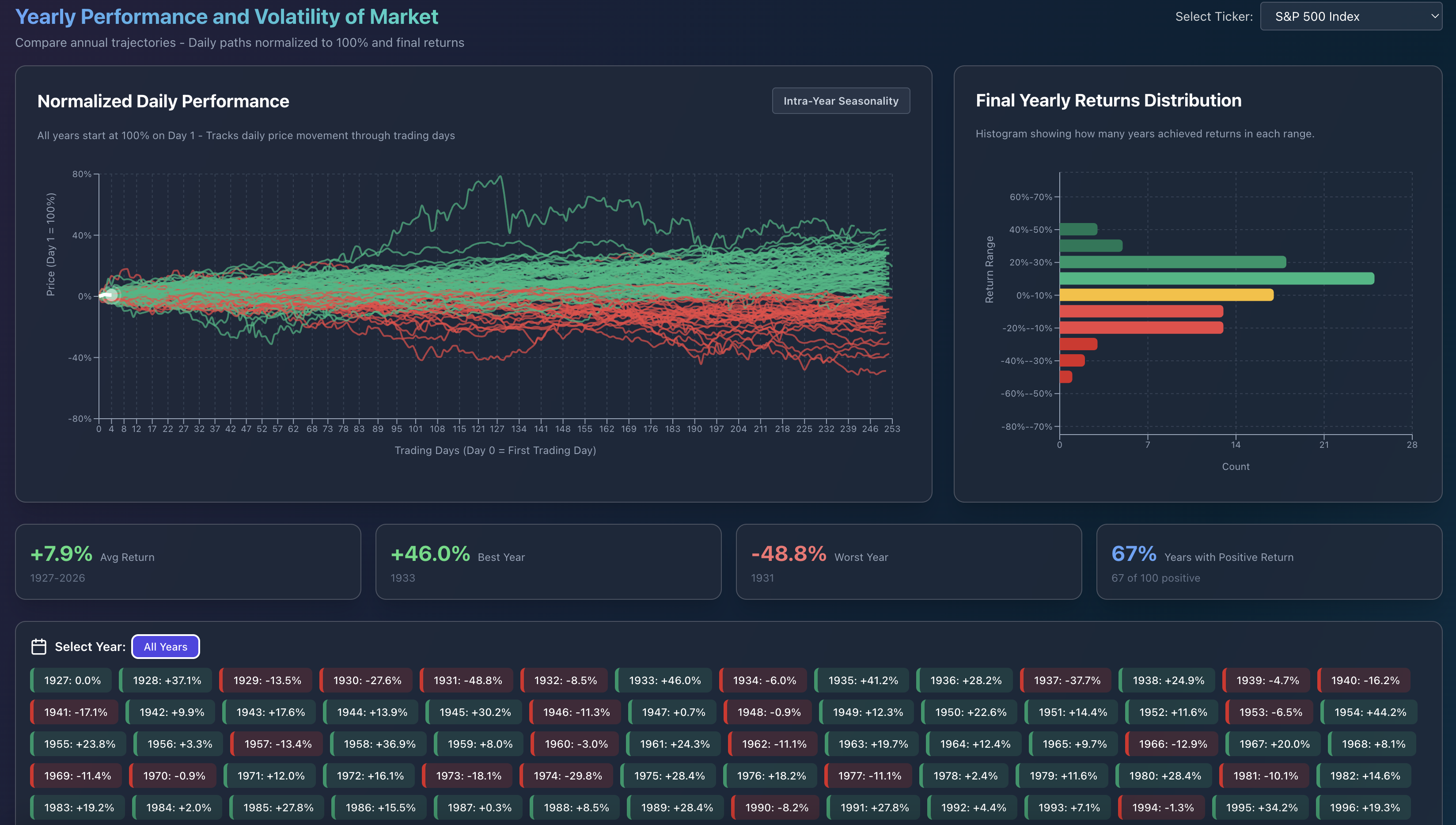

Historical Returns & Volatility

Develop a realistic and healthy mindset for investing in the stock market by understanding historical returns and volatility patterns. Learn what to expect from long-term market performance and how volatility is a natural part of the investing journey.

Build correct expectations about market behavior through comprehensive analysis of historical data. This understanding helps you maintain perspective during market fluctuations and stay committed to your long-term investment strategy.

Bull/Bear Markets Virtual Tour

Experience firsthand how challenging it is to stay invested through bull and bear market cycles. Navigate through the emotional rollercoaster of market volatility and noise that surrounds every market cycle.

Strengthen your emotional stability and resilience through immersive simulation of staying in the markets during turbulent times. Learn to manage the psychological pressure that comes with market ups and downs, building the mental fortitude needed for successful long-term investing.

Asset Rotations

Gain a deep sense of market cycles by exploring how different asset classes rotate through various phases. Study historical patterns of asset rotations to understand the natural rhythm of market cycles.

Identify where we currently are in the market cycle by analyzing rotation patterns across equities, bonds, commodities, and other asset classes. Learn from past cycles to make more informed decisions about current market positioning.

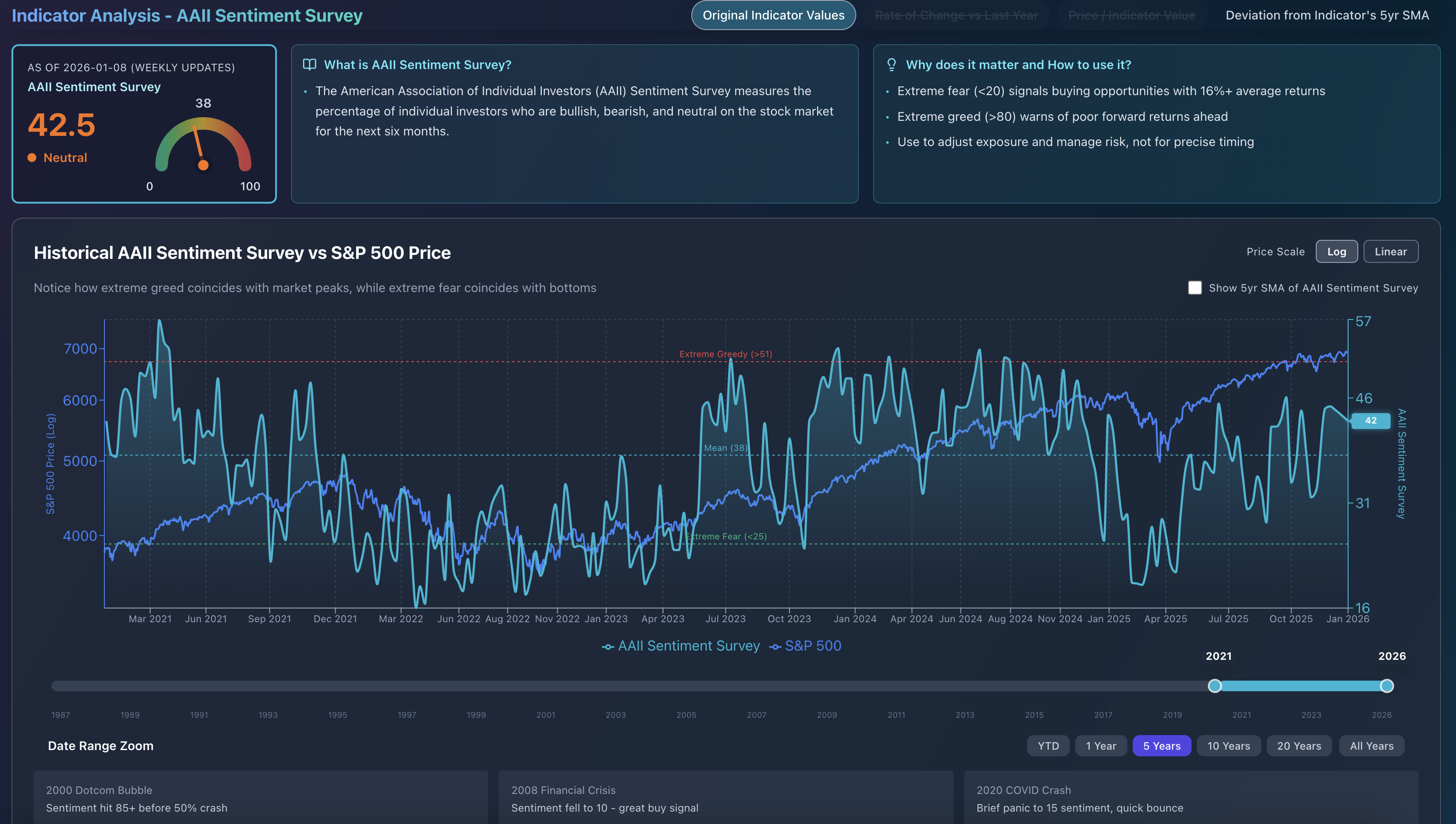

Indicator Analysis

Comprehensive analysis of key market indicators across sentiment, valuation, technical, and liquidity metrics. Our dashboard synthesizes complex data into clear, actionable signals.

Monitor multiple indicators simultaneously and understand how they interact to form a complete picture of market conditions and opportunities.

Backtesting Signals

Test your investment strategies against decades of historical market data. See how different signals and approaches would have performed across various market conditions.

Compare strategy performance against benchmarks, analyze drawdowns and recovery periods, and refine your approach before risking real capital.

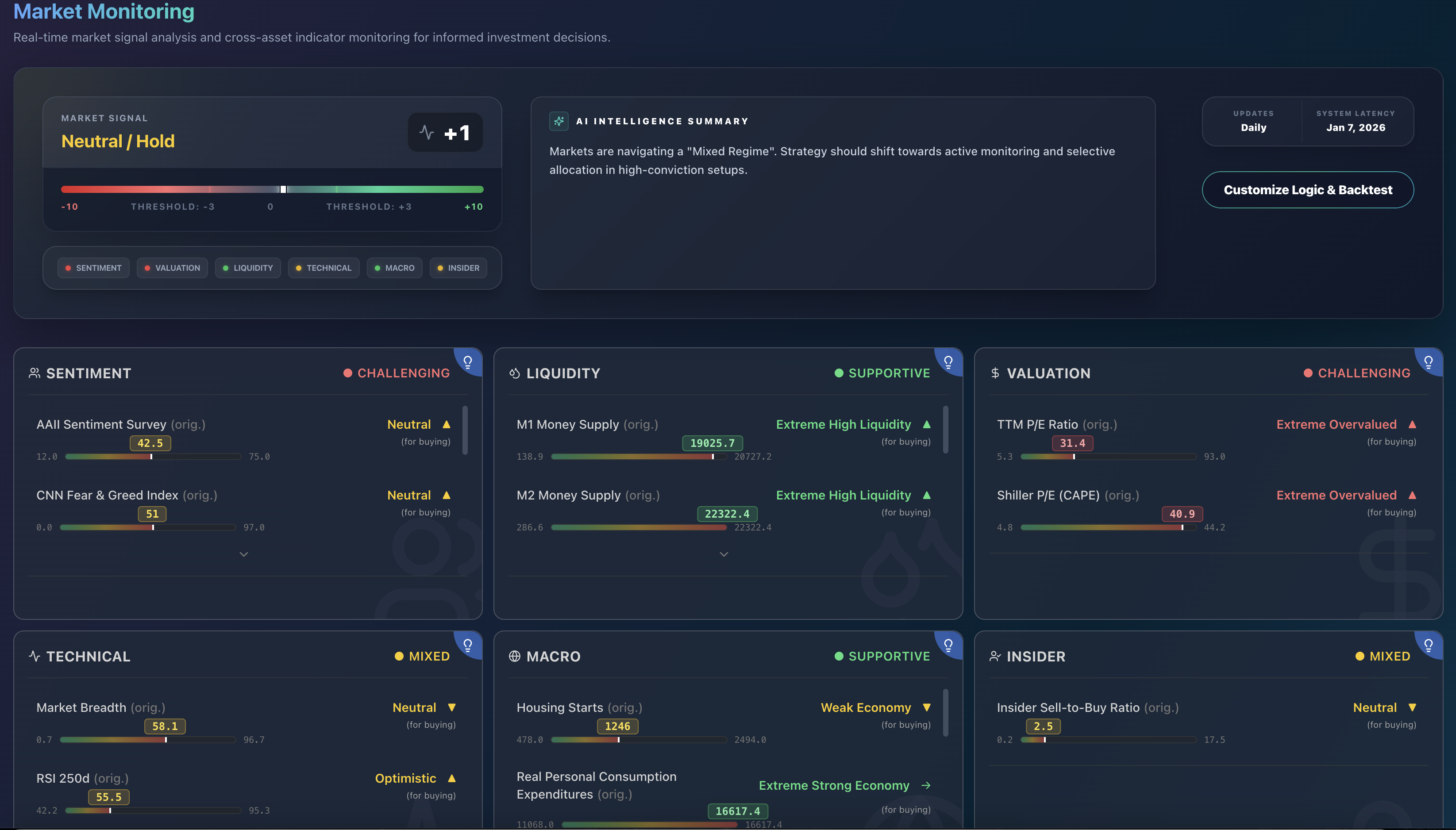

Market Monitoring

Stay informed with real-time market monitoring and alerts. Track key market metrics, opportunity scores, and potential risk signals as they develop.

Receive timely notifications about significant market movements, valuation extremes, and other critical indicators that may impact your investment decisions.

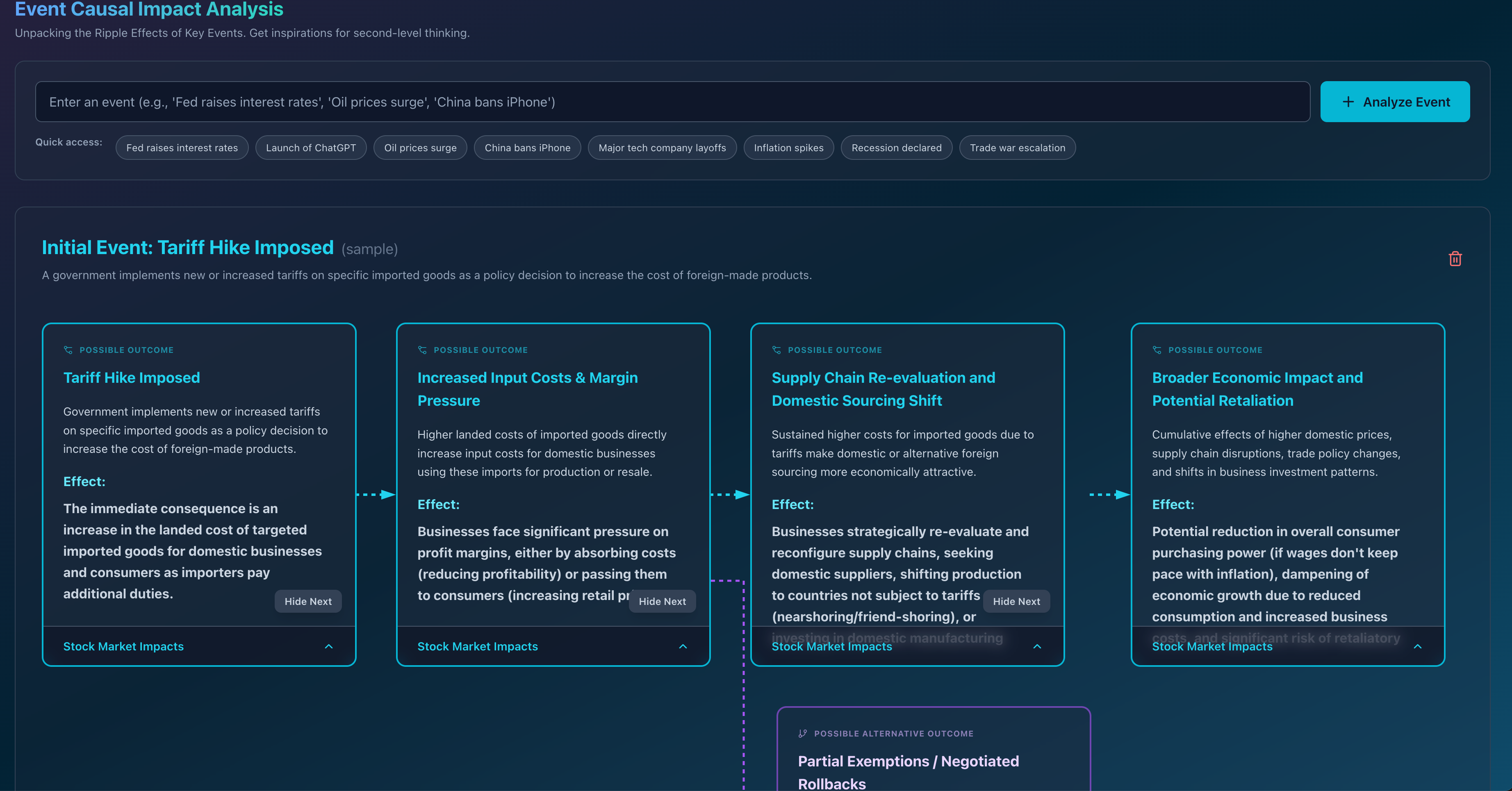

Event Impact Analysis

Develop independent and second-level thinking skills by analyzing how major economic and market events actually impacted markets versus how they were portrayed in the media. See through the noise of biased news coverage to understand what really happened.

Practice critical thinking by examining historical events from multiple angles and questioning mainstream narratives. Learn to distinguish between media hype and genuine market impact, building the analytical skills needed to make independent investment decisions in an information-saturated world.

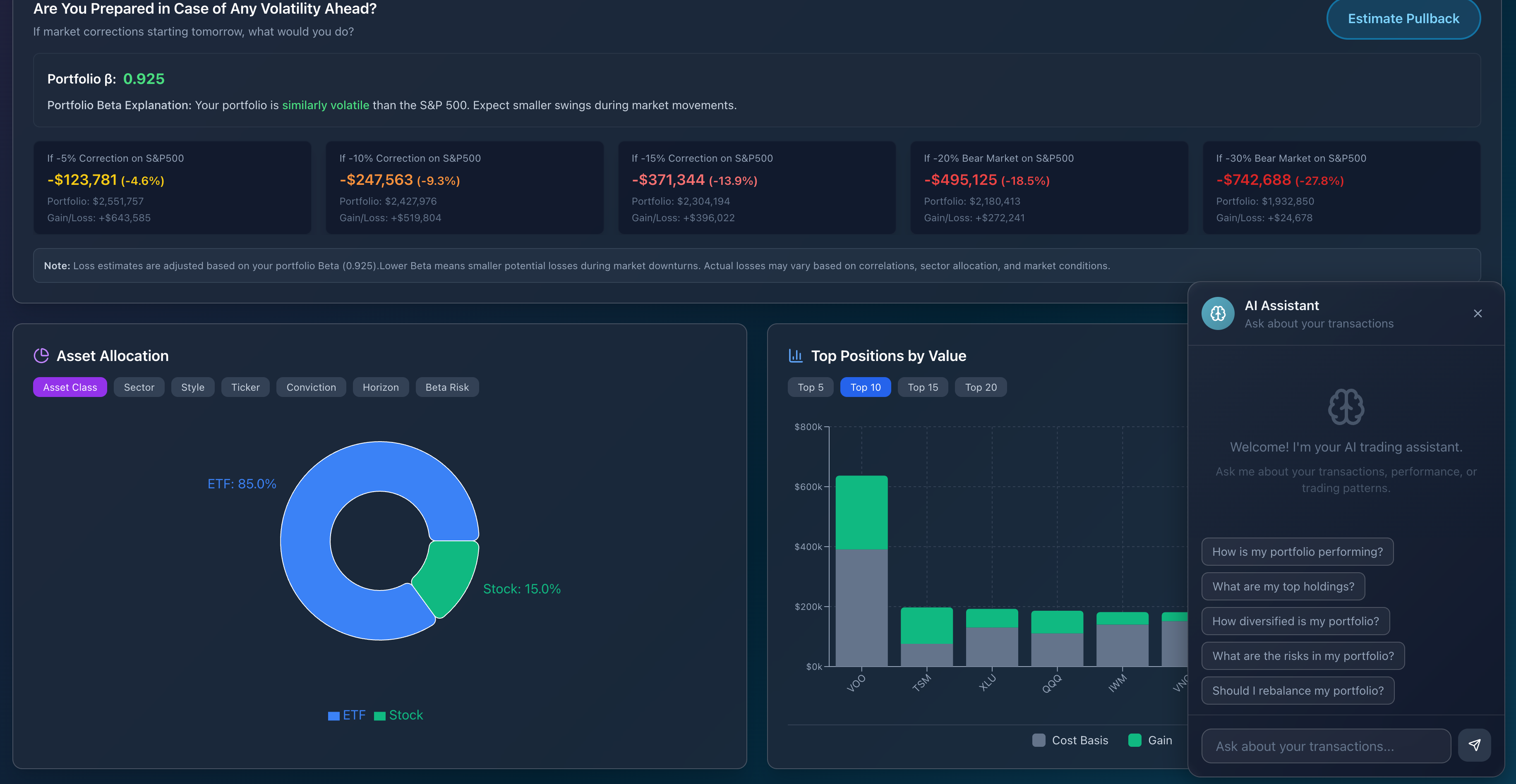

Portfolio Review

Assess your conviction in each holding and prepare for market volatility through comprehensive portfolio reviews. Our AI assistant helps you evaluate your asset allocation, sector exposure, and overall portfolio health with detailed analytics.

Work with the AI assistant to identify areas for improvement, rebalancing opportunities, and ensure your portfolio aligns with your investment goals and risk tolerance, especially during turbulent market conditions.

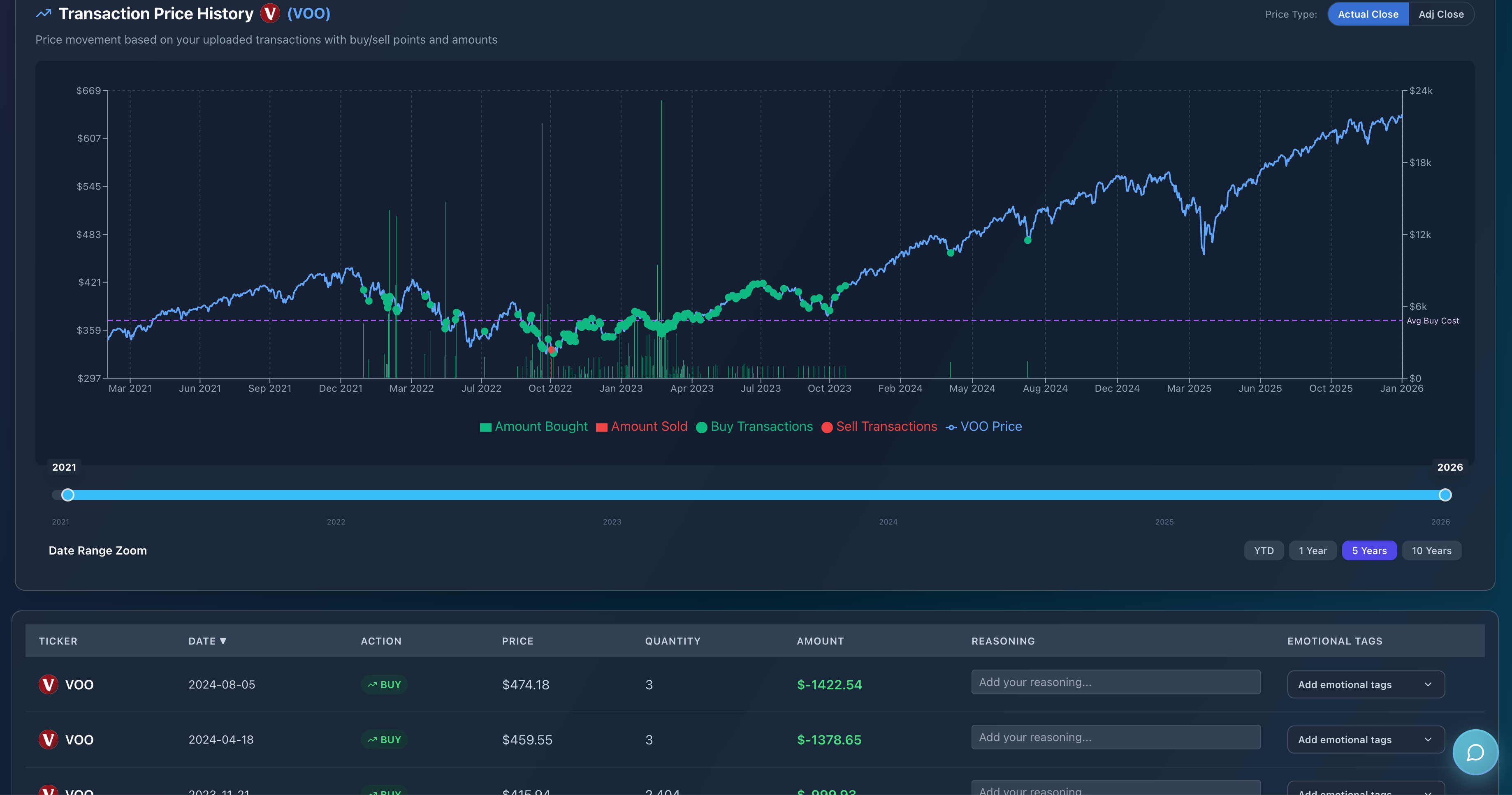

Transactions Review

Review and analyze all your investment transactions in one comprehensive view. Besides tracking transaction history, you can record the reasoning behind each decision and tag your emotional status at the time of the transaction.

Gain insights into your trading patterns, frequency, and decision-making process by reviewing both the quantitative data and the emotional context of your transactions. This holistic view helps you identify patterns in your behavior and refine your investment approach over time.

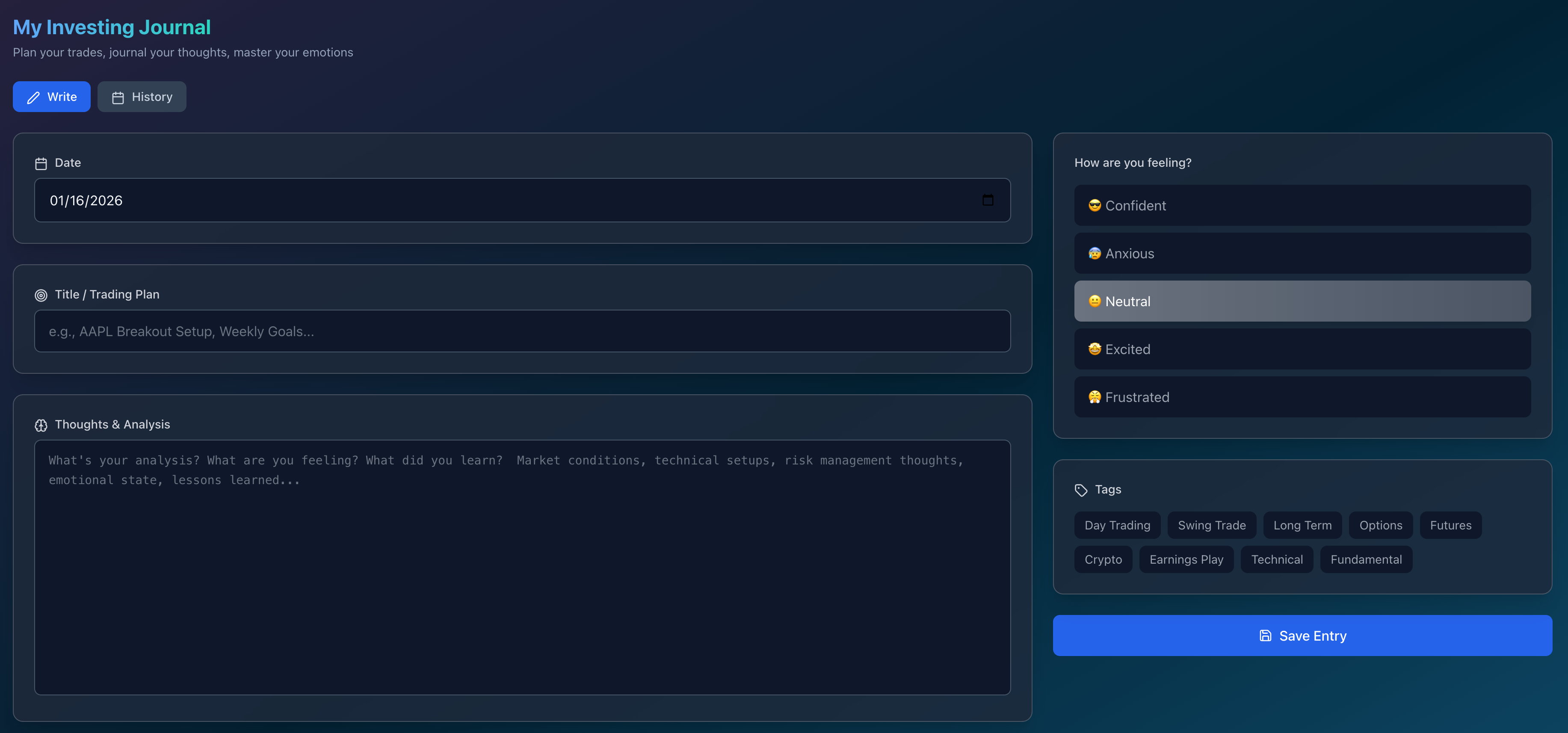

Investment Journal

Document your investment journey with a comprehensive journaling system. Record your thoughts, decisions, and the reasoning behind each investment choice.

Learn from both successes and setbacks by maintaining a detailed record of your investment process. Build wisdom over time by reviewing past decisions and refining your approach.

Choose Your Plan

Select the perfect plan to supercharge your investing decisions

Starter

For individuals starting their financial journey

- AI-powered insights

- Basic portfolio tracking

- Educational resources

- Limited access to indicators

- Maxium 10 years of historical data backtesting

Serious Investors

For individuals invest seriously and strategically

- Everything in Starter

- Advanced analytics

- Custom indicators

- Portfolio optimization

- Transaction analysis

- Full years of historical data backtesting

Frequently Asked Questions

Find answers to common questions about Rationa